Reliance Communications which has been silent on giving out numbers on the performance of its subsidiaries [Reliance Big TV DTH] had to disclose its Accounts when we demanded through the Ministry of Corporate Affairs.

Reliance big TV DTH business generated revenue and net loss of Rs1.1b and Rs0.8b respectively over an asset base of Rs3.4b.

RITL's revenue and net profit were Rs49.3b and Rs16.9b respect. over an asset base of Rs207.6b

Tuesday, September 08, 2009

Wednesday, July 22, 2009

Sun Direct TV inks deal with IBM

Chennai-based Sun Direct TV, part of the Sun TV Group, has inked agreement with IBM to employ and manage Customer Relationship Management (CRM) related applications for Sun Direct TV.

Being the multi-year deal, it comprises end-to-end services ranging from strategy through implementation, and displaces Sun Microsystems, the incumbent provider.

Launched in December 2007, Sun Direct TV presently has a base of 3 million subscribers. The company expects to expand its customer base to 10 million by 2010 with implementation of this CRM platform.

The CRM platform will help Sun Direct TV to tackle key issues surrounding billing, customer relationship management and develop ways to get better insights on customer behaviour. IBM will develop and maintain a dynamic infrastructure for Sun Direct TV.

Being the multi-year deal, it comprises end-to-end services ranging from strategy through implementation, and displaces Sun Microsystems, the incumbent provider.

Launched in December 2007, Sun Direct TV presently has a base of 3 million subscribers. The company expects to expand its customer base to 10 million by 2010 with implementation of this CRM platform.

The CRM platform will help Sun Direct TV to tackle key issues surrounding billing, customer relationship management and develop ways to get better insights on customer behaviour. IBM will develop and maintain a dynamic infrastructure for Sun Direct TV.

Tuesday, July 21, 2009

Dish TV rises despite hike in tariff rates

Part of Essel Group, Dish TV India has announced to increase its tariff plans by Rs 100 across India. The move comes after Government's imposition of 5% custom duty on import of set top boxes proposed in current budget.

The hike in custom duty has led a rise in input cost of set top boxes. The business model of DTH is based on subsidy and the component cost has surged considerably due to the increase in dollar exchange rate in the last one year.

Company’s set top box which was priced at Rs 1490 will now cost Rs 1,590. Similarly under its combo offer of Rs 2090 plus 3 months platinum/south platinum, will now cost Rs 2,190, whereas its others 'Ultimate sports bonanza' of Rs 1,790 and Rs 2,300 each will be available at Rs 1,890 and Rs 2,490 respectively.

The hike in custom duty has led a rise in input cost of set top boxes. The business model of DTH is based on subsidy and the component cost has surged considerably due to the increase in dollar exchange rate in the last one year.

Company’s set top box which was priced at Rs 1490 will now cost Rs 1,590. Similarly under its combo offer of Rs 2090 plus 3 months platinum/south platinum, will now cost Rs 2,190, whereas its others 'Ultimate sports bonanza' of Rs 1,790 and Rs 2,300 each will be available at Rs 1,890 and Rs 2,490 respectively.

Friday, June 12, 2009

DTH industry wants duty free import of set top boxes

The direct-to-home (DTH) industry is demanding a duty free regime for imported set top boxes as the industry feels that import duties on these are resulting in increase in cost being borne by the consumer and hence slowing the pace of expansion of the industry. A similar demand has also been made by the cable TV industry.

Economists argue that such a move will have a positive impact on government’s revenue on a net basis as reduction in cost of installation will increase business in both the DTH as well as the cable segment.

Even the information and broadcasting ministry (I&B) has argued that it is in the government’s own financial interest to eliminate all import duties for at least the next five years on digital set top boxes for both cable and direct-to-home segments. The ministry has raised the issue before the finance ministry in the pre-budget consultations which are currently going on for the Union budget for FY10.

At present, imported digital set top boxes attract a special additional duty at the rate of 4% as well as a countervailing duty at 8%. Together these two raises the cost of set top boxes by 12%. The I&B ministry feels that both the duties should be cut for the next five years which will help boost growth of the industry.

Economists argue that such a move will have a positive impact on government’s revenue on a net basis as reduction in cost of installation will increase business in both the DTH as well as the cable segment.

Even the information and broadcasting ministry (I&B) has argued that it is in the government’s own financial interest to eliminate all import duties for at least the next five years on digital set top boxes for both cable and direct-to-home segments. The ministry has raised the issue before the finance ministry in the pre-budget consultations which are currently going on for the Union budget for FY10.

At present, imported digital set top boxes attract a special additional duty at the rate of 4% as well as a countervailing duty at 8%. Together these two raises the cost of set top boxes by 12%. The I&B ministry feels that both the duties should be cut for the next five years which will help boost growth of the industry.

Monday, June 08, 2009

Videocon to launch DTH service on June 20, 2009

Videocon, the domestic consumer electronics major, is planning to launch its direct-to-home (DTH) service in Kolkata at proposed date June 20, 2009. Bharat Business Channel (BBCL), a subsidiary of the Videocon Group will handle DTH service. The company will market its DTH services through around 30,000 dealers. The company will sell its DTH service under the brand name D2H+.

Videocon will roll out colour television will in built set-top box in a price range of Rs 8,000. The company will manufacture the set top boxes at its Aurangabad factory, which will be priced at Rs 4,000.

Under DTH services segment, company plans to create customer base of 2 million subscribers in the current fiscal. Later in FY 2010-11, it plans to reach 5 million customers. The company has set a target for itself of reaching 1 crore houses, within a period of five years.

On August 15, 2009, the company plans to launch its GSM mobile service in Chennai. Videocon will handle its mobile service segment through its subsidiary Datacom.

Videocon will roll out colour television will in built set-top box in a price range of Rs 8,000. The company will manufacture the set top boxes at its Aurangabad factory, which will be priced at Rs 4,000.

Under DTH services segment, company plans to create customer base of 2 million subscribers in the current fiscal. Later in FY 2010-11, it plans to reach 5 million customers. The company has set a target for itself of reaching 1 crore houses, within a period of five years.

On August 15, 2009, the company plans to launch its GSM mobile service in Chennai. Videocon will handle its mobile service segment through its subsidiary Datacom.

Monday, May 11, 2009

Registered base crosses 5.20 million

Dish TV India Limited (dishtv), India's No. 1 direct-to-home company and part of India’s biggest media conglomerate - Zee group, added 136,330 new subscribers in the month of April 2009, taking its total registered base to over 5.20 million. The adoption of the DTH market category in the month of April was 0.72 million subscribers approximately.

The new proposition is substantiated through dishtv’s competitive advantage, as it offers within competition the maximum width and depth of content, with 240 channels and services. dishtv also offers the maximum channels across genres/languages to its subscribers along with maximum value at every price point. This gives dishtv a unique edge over cable and other DTH players, which show limited regional content.

The new proposition is substantiated through dishtv’s competitive advantage, as it offers within competition the maximum width and depth of content, with 240 channels and services. dishtv also offers the maximum channels across genres/languages to its subscribers along with maximum value at every price point. This gives dishtv a unique edge over cable and other DTH players, which show limited regional content.

Saturday, April 11, 2009

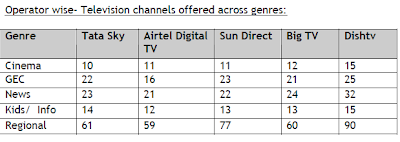

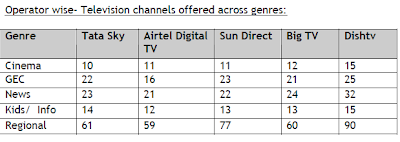

Tata Sky + Sun Direct TV Channel Offerings

We are presenting to you the number of channels offered by each of the DTH Service providers [DishTV, Tata Sky, Sun Direct, Reliance big TV and Airtel Digital TV] in India. Here is the breakup.

DTH Operator wise offering

DTH Operator wise offering

DTH Operator wise offering

DTH Operator wise offering

Wednesday, March 18, 2009

Depreciating rupee a cause of concern for DTH players

The depreciating rupee against the dollar impacted the direct-to-home (DTH) industry adversely owing to import of set-top boxes (STB) at nearly 10-15% increased prices and offering to the subscribers at a subsidized rate.

Since the appreciating dollar has caused a rise of almost 10-15% in prices of import-dependent set-top boxes, industry players are concerned over the fate of revenues and viability. Even after service duty reduction, the DTH industry has not been benefited much owing to the slipping rupee.

Since the appreciating dollar has caused a rise of almost 10-15% in prices of import-dependent set-top boxes, industry players are concerned over the fate of revenues and viability. Even after service duty reduction, the DTH industry has not been benefited much owing to the slipping rupee.

Sun TV - Analyst Call Takeaways

We recently met the management of Sun TV. The key takeaways from the meeting are:

Ad revenues: Although the outlook on advertisement revenues is challenging, the company expects to increase ad revenues by increasing inventory utilization (current inventory utilization level is ~50-55%). However it believes that ad rate hikes are unlikely. Sun TV had increased rates by ~10% in Feb, 2008. Broadcast fee rates depend strongly on the ad-spends scenario. FMCG (55%) is the highest contributor of advertisement revenues for Sun TV. The ad mix in terms of Regional:National is ~30:70. This has protected Sun TV as both FMCG and regional advertisers continue to remain buoyant.

DTH subscribers: Sun TV had ~3.3 mn DTH subscribers as of Dec 08. This is expected to increase to 3.8 mn by end of March ‘09. Its ARPU from DTH subscribers is INR 26 per month currently. Company expects significant ramp up in DTH subscribers and revenues in FY10.

Analogue revenues: Sun TV expects to increase it analogue subscription revenues by 15-20% in FY10.

International revenues: The company is receiving overseas revenues from Malaysia, Singapore, Canada, Sri Lanka, and UK. In the US the company is present only in the DTH distribution network, and soon expects to be carried by other digital and analog carriers also. It expects 10-15% incremental revenues from this stream. Currently Sun TV’s forex exposure is only in USD and it has benefitted from the recent appreciation of the currency.

Competition: Kalaignar TV's market share is much below compared to Sun TV (Tamil GEC). However, according to our industry checks Kalaignar TV has been able to boost its presence strongly with programming of comparable quality, which could turn out to be a potential threat for Sun TV. In the presence of these two channels others players have been further marginalized in a market which was already dominated by Sun TV.

Movie production: In the movie production business Sun TV would be closing FY09 with 6 movies, all under INR 50 mn cost of production. Out of these 6 movies, it is currently carrying 5 movies on its balance sheet - under intangibles - which will be written off after 1st broadcast. In FY10 the company plans to invest INR 500 - 700 mn in the business, producing 8-10 movies with an average return expectation of 20-25%.

Radio: In the radio business, the company expects a topline of INR 300 mn and a loss of INR 600 mn in FY09. For FY10, the company expects to reduce net loss to INR 400 – 450 mn on a topline of INR 400 mn. It is also expecting to break-even in FY11. All the stations together will be fully operational for the first time in FY10. It has been constantly cutting down on redundant expenses in the business.

Capex: On broader financial aspects – Sun TV doesn’t expect any significant surprises on the operating costs front. Cap-ex planned for FY10 is ~INR 2.5 bn (INR 1 bn for enhancing its movie library, INR 400 mn for broadcasting business, INR 100 mn for the radio business and INR 1 bn for office premises).

Ad revenues: Although the outlook on advertisement revenues is challenging, the company expects to increase ad revenues by increasing inventory utilization (current inventory utilization level is ~50-55%). However it believes that ad rate hikes are unlikely. Sun TV had increased rates by ~10% in Feb, 2008. Broadcast fee rates depend strongly on the ad-spends scenario. FMCG (55%) is the highest contributor of advertisement revenues for Sun TV. The ad mix in terms of Regional:National is ~30:70. This has protected Sun TV as both FMCG and regional advertisers continue to remain buoyant.

DTH subscribers: Sun TV had ~3.3 mn DTH subscribers as of Dec 08. This is expected to increase to 3.8 mn by end of March ‘09. Its ARPU from DTH subscribers is INR 26 per month currently. Company expects significant ramp up in DTH subscribers and revenues in FY10.

Analogue revenues: Sun TV expects to increase it analogue subscription revenues by 15-20% in FY10.

International revenues: The company is receiving overseas revenues from Malaysia, Singapore, Canada, Sri Lanka, and UK. In the US the company is present only in the DTH distribution network, and soon expects to be carried by other digital and analog carriers also. It expects 10-15% incremental revenues from this stream. Currently Sun TV’s forex exposure is only in USD and it has benefitted from the recent appreciation of the currency.

Competition: Kalaignar TV's market share is much below compared to Sun TV (Tamil GEC). However, according to our industry checks Kalaignar TV has been able to boost its presence strongly with programming of comparable quality, which could turn out to be a potential threat for Sun TV. In the presence of these two channels others players have been further marginalized in a market which was already dominated by Sun TV.

Movie production: In the movie production business Sun TV would be closing FY09 with 6 movies, all under INR 50 mn cost of production. Out of these 6 movies, it is currently carrying 5 movies on its balance sheet - under intangibles - which will be written off after 1st broadcast. In FY10 the company plans to invest INR 500 - 700 mn in the business, producing 8-10 movies with an average return expectation of 20-25%.

Radio: In the radio business, the company expects a topline of INR 300 mn and a loss of INR 600 mn in FY09. For FY10, the company expects to reduce net loss to INR 400 – 450 mn on a topline of INR 400 mn. It is also expecting to break-even in FY11. All the stations together will be fully operational for the first time in FY10. It has been constantly cutting down on redundant expenses in the business.

Capex: On broader financial aspects – Sun TV doesn’t expect any significant surprises on the operating costs front. Cap-ex planned for FY10 is ~INR 2.5 bn (INR 1 bn for enhancing its movie library, INR 400 mn for broadcasting business, INR 100 mn for the radio business and INR 1 bn for office premises).

Subscribe to:

Comments (Atom)